Q. 1. Choose the correct option :

1) Statements that are true about the Planning Commission :

a) Planning Commission was established in 1950.

b) The Prime Minister is the Ex-Officio Chairman of Planning Commission.

c) Economic planning is a time bound programme.

d) Economic planning is based on predetermined objectives.

Options :

1) a and b

2) a, b, c and d

3) a and c

4) None of these

2) Statements that are incorrect regarding India’s five year plans :

a) The main objective of first five year plan was development of agriculture.

b) Social welfare and poverty eradication were the prime objectives of the seventh five year plan.

c) By the second five year plan, focus increased on faster, inclusive growth.

d) Development of both agriculture and industry were the main objectives of the third five year plan.

Options :

1) a

2) a, b and d

3) c

4) b and d

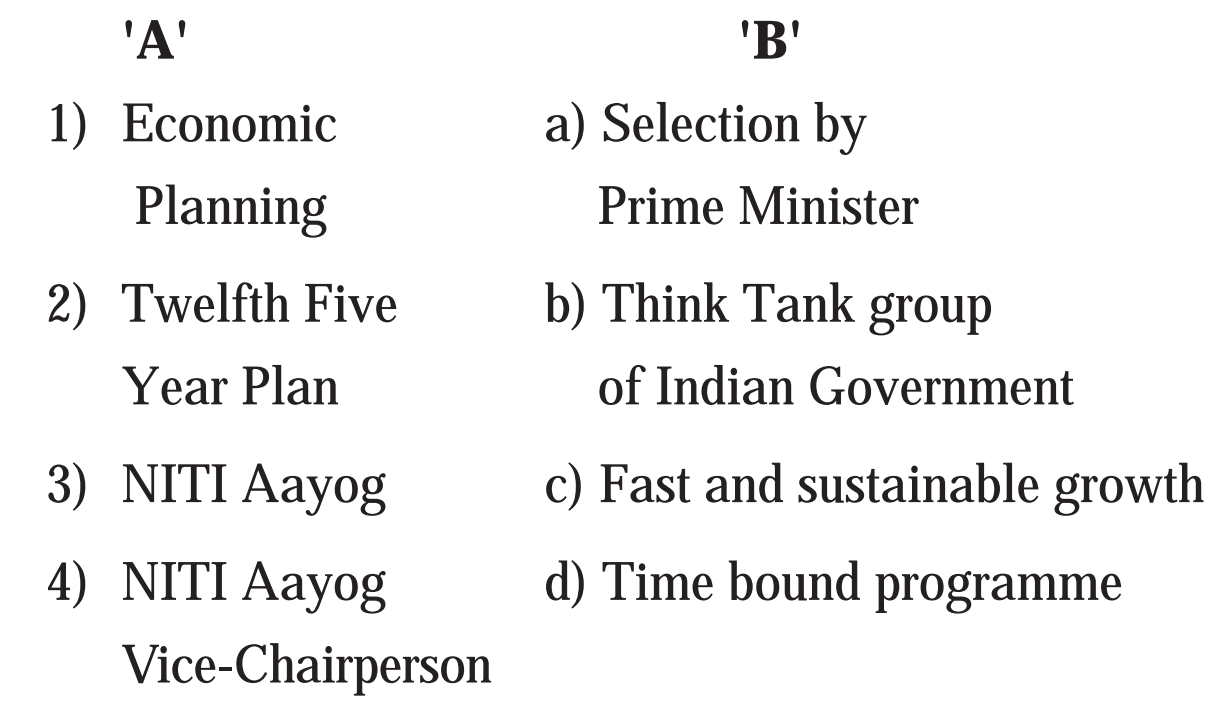

3) Identify the correct of pairs from the given options :

Options :

(1) 1-c, 2-a, 3-d, 4-b

(2) 1-d, 2-b, 3-a, 4-c

(3) 1-d, 2-c, 3-b, 4-a

(4) 1-b, 2-d, 3-c, 4-a

4) Choose the correct statement :

Statement 1 – NITI Aayog takes note of dynamic change in the Indian economy.

Statement 2 – Considering the economic, social and technological differences in underdeveloped districts, the body plans to implement various programmes and bring about economic changes.

Options :

a) statement 1 is correct

b) statement 2 is correct

c) statement 2 is the result of statement 1

d) there is no relation between statement 1 and statement 2.

Q. 2. Give economic terms :

1) Conscious and deliberate choice of economic priorities by some public authority.

Ans.

Conscious and deliberate choice of economic priorities by some public authority – Economic Planning

2) A group of people called forth by the government to discuss various problems and also try to find solutions to them.

Ans.

A group of people called forth by the government to discuss various problems and also try to find solutions to them – NITI Aayog.

Q. 3. Identify and explain the concepts from the given illustrations :

1) Sayali’s mother maintains a book of accounts for household purpose and plans the expenditure accordingly.

Ans.

A) Identify concept: Economic planning

B) Explanation of concept: Economic planning is a conscious and deliberate choice of economic priorities by an individual or public authority.

2) Ramabai gets a subsidy on domestic LPG directly transferred to her bank a/c.

Ans.

a) Identify the concept: direct cash transfer.

b) Explanation of concept: direct cash transfer was one of the targets of the 12th five-year plan in which major subsidies and welfare-related beneficiaries were to be shifted to a direct cash transfer by using aadhar platform linked with bank a/cs.

3) To solve classroom related issues, the teacher forms a group of students. This group discusses the problems and finds solutions to it

Ans.

A) Identify concept: Think tank.

B) Explanation of concept: A Think tank is a group of experts who are gathered together by a person or organization in order to consider various problems, try and work out ways to solve them.

Q. 4. Answer the Following :

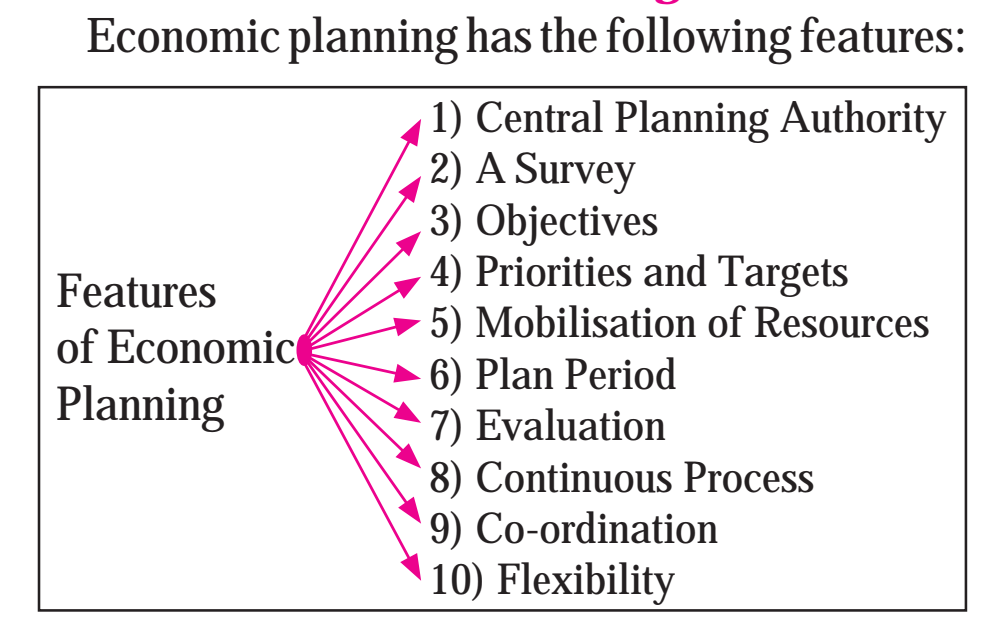

1) Explain the features of Economic Planning.

Ans.

1) Central Planning Authority : Central Planning Authority in a country undertakes economic planning. In India, it was known as Planning Commission. It has been replaced by National Institution for Transforming India i.e. NITI Aayog since 2015.

2) A Survey : A comprehensive survey of the economy is undertaken regarding the availability and utilisation of human and natural resources.

3) Objectives : Economic planning is based on certain pre-determined objectives which are realistic and flexible.

4) Priorities and targets : Priorities are fixed according to the importance of each sector for accelerating economic development. Target is the concrete step towards the attainment of objectives.

5) Mobilisation of Resources : The resources needed for planning are mobilised through various sources like taxation, domestic savings, deficit financing, public debt, external assistance etc.

6) Plan Period : Plan period varies as per needs. In countries like India, planning is generally for a period of five years.

7) Evaluation : Periodic assessment such as mid term appraisal is done to incorporate necessary changes in priorities and targets of the plan.

8) Continuous Process : Economic planning is a continuous process. It aims at economic development of the country.

9) Co-ordination : States of the country also undertake economic planning along with the centre. Thus, co-ordination between the centre and states is ensured.

10) Flexibility : Central Planning Authority maintains flexibility in its approach. This makes it possible to incorporate necessary changes in the plan as per requirements during its implementation.

2) Explain the targets of 12th Five Year plan.

Ans.

The targets of 12th Five Year Plan were as follows:

1) Economic Growth :

• Real GDP growth rate at 8% to be achieved.

• Agriculture growth rate at 4.0% to be gained.

• Manufacturing or Industrial growth rate at 10% to be achieved.

• Every State must have a higher average growth rate in the 12th plan than what was achieved in the 11th plan.

2) Poverty and Employment :

• To reduce head-count ratio of poverty by 10%.

• To create 50 million new work opportunities in the non-farm sector.

3) Education :

• Mean years of schooling to increase to seven years by the end of the twelfth plan.

• Access to higher education with reference to skill development.

• Eliminate gender and social gap in school enrolment by the end of this plan.

4) Health :

• Reduce total fertility rate to 2.1%

• Reduce undernutrition among children in the age group of 0 to 3 years to half of the NFHS-3 levels.

5) Infrastructure :

• Investment in infrastructure to be increased to 9% of GDP.

• Connect all villages with all weather roads.

• Increase in rural television and telephone density to 70%

6) Environment and sustainability :

• Increase green cover by 1 million hectare every year during the 12th plan period.

7) Service Delivery :

• Provide access to banking services to 90% Indian households by the end of the plan.

• Major subsidies and welfare related beneficiaries to be shifted to a direct cash transfer by using the Aadhar platform linked with bank accounts.

3) Explain the structure of NITI Aayog.

Ans.

The structure of N ITI Aayog can be explained as follows:

1) Governing Council : Comprising of the Chief Ministers of all States and Governors of Union Territories.

2) Regional Councils : These would be formed to address specific issues and contingencies impacting more than one state or region.

3) Special Invitees : These would include experts, specialists and practitioners with relevant knowledge who will be nominated by the Prime Minister.

4) Organisational Framework :

• Chairperson : Prime Minister of India

• Vice Chairperson : To be appointed by the Prime Minister.

Full time members – 5

Part time members – 2

• Ex-Officio Members : Maximum of 4 members of the Union Council of Ministers to be nominated by the Prime Minister.

• Chief Executive Officer (CEO) : To be appointed by the Prime Minister for a fixed tenure, in the rank of Secretary to the Government of India.

• Secretariat- As deemed necessary

4) Explain the functions of NITI Ayog.

Ans.

The functions of NITI Aayog are as follows :

1) Shared National Agenda : Evolves a shared vision of national development priorities and strategies with the active involvement of states. This will provide a framework of ‘National Agenda’ for the Prime Minister and Chief Ministers to implement.

2) States’ Best Friend at the Centre : Supports states in addressing their own challenges, building on strengths and comparative advantages. This will be through various means such as co-ordinating with Ministries, championing their ideas at the centre, providing consultancy support and building capacity.

3) Decentralized Planning : Restructuring the planning process into bottom-up model, from village-level i.e. local government to national level or central government.

4) Knowledge and Innovation Hub : Be an accumulator as well as booster of research and best practices on good governance, through a State-of-the-art Resource centre which identifies, analyses, shares and facilitates replication of the same.

5) Monitoring and Evaluation : Monitor the implementation of policies and programmes and evaluate their impact through rigorous tracking of performance metrics and comprehensive programme evaluations. This will identfy weaknesses and bottlenecks for necessary course correction, enable datedriven policy making, encouraging greater efficiency and effectiveness.

6) Co-operative and Competitive Federalism : Be the primary platform for operationalizing co-operative federalism, enabling states to have active participation in the formulation of national policy and achieving time-bound implementation of quantitative and qualitative targets through the combined authority of the Prime Minister and Chief Ministers of the states.

7) Others Functions :

• Inter consultancy

• Conflict Resolution

• Technological upgradation

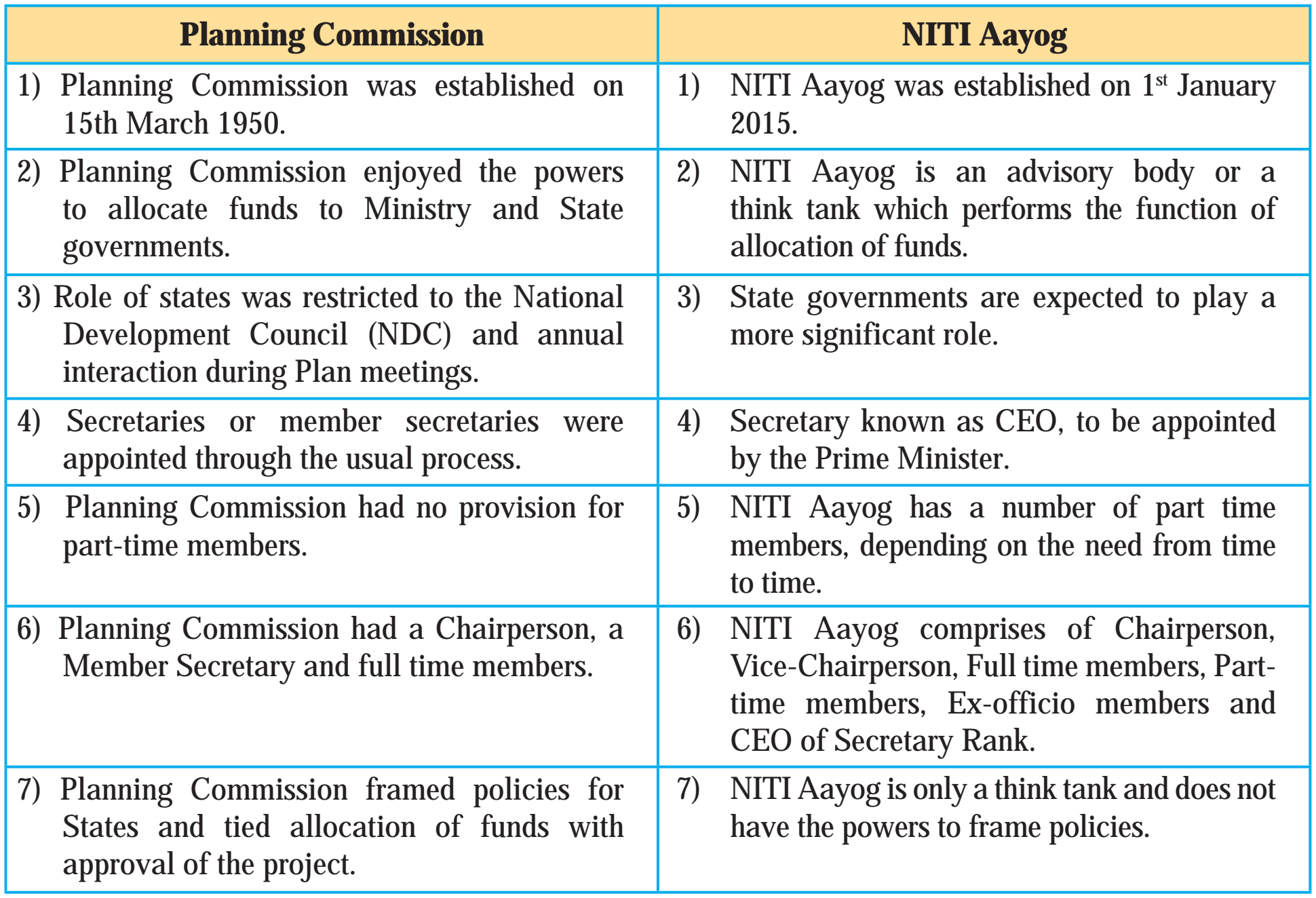

5) Distinguish between Planning Commission and NITI Aayog

Ans.

Planning Commission and NITI Aayog can be distinguished as follows:

Q. 5. State with reasons whether you agree or disagree with the following statements :

1) State governments have more significant role to play under NITI Aayog.

Ans.

Yes, I agree with this statement.

Reasons: ‘

1. NITI Aayog assumes the active role of states in the implementation of plans. NITI provides a framework of National Agenda for the Prime Minister and Chief Ministers for Implementation.

2. NITI Aayog supports the states in addressing It helps the states b3: a way of coordinating with Ministers, championing their ideas at the centre, providing consultancy support, and building capacity.

3. NITI Aayog reconstructs the planning process into a bottom-up model. It stresses on planning from Village level 1.6. local government to the national level or central government.

4. Thus, State governments have a more significant role to play under NITI Aayog.

2) Functions of Planning Commission has been transferred to NITI Ayog.

Ans.

Yes, I agree with this statement.

Reasons:

1. In India, economic planning is undertaken by the Central Planning Authority. In India, it was known as Planning Commission up to 2015.

2. Since 2015, Planning Commission has been replaced by National Institution for Transforming India i.e. NITI Aayog.

3. Resolution of NITI Aayog was sanctioned on 1st January, 20 15, and its actual execution started after the completion of the 12th Five Year Plan.

4. Thus, the functions of the Planning Commission “have been transferred to NITI Aayog.

3) The objective of the12th five year plan was to achieve a faster, sustainable and inclusive growth

Ans.

Yes, I agree with this statement.

Reasons:

1. The 12th five-year plan had a target growth rate of 8 percent. It had a target growth rate of 4 percent for the agricultural sector and a target growth rate of 10 percent for the industrial sector.

2. It also had a target of reducing the headcount ratio of poverty by 10 percent.

3. It also had targets for the spread of education and health facilities, development of infrastructure. sustaining environment, etc.

4. Thus, the objective of the 12th five-year plan was to achieve faster, sustainable and inclusive growth.

Q. 6. Read the following passage carefully and answer the questions :

The Finance Minister of the Central Government presents the Union Budget before the Parliament during the month of February every year. The budget, also referred to as the annual financial statement reflects the estimated receipts and expenditure of the government for a particular financial year that begins on the 1st of April and ends on 31st March. Changes in the tax structure are suggested in the budget. Besides this, provisions are also made for allocating expenditure on defence, education, research and development etc. The date for presenting the budget has been shifted to the 1st of February every year. This enables generation of funds well in advance prior to the commencement of the financial year.

1) Where is the Union Budget usually presented?

2) What all aspects are considered while preparing the budget?

3) Why is the date for presenting the budget shifted to the 1st of February?

4) Explain the term ‘budget’.

Ans.

(1) The Union Budget is usually presented in parliament.

(2) The aspects like defence, education, infrastructure are considered while preparing the budget.

(3) The date for presenting the budget is shifted to the 1st of February for enabling the generation of funds well in advance prior to the commencement of the financial year.

(4) The budget is the record of annual financial statements reflecting the estimated receipts and expenditure of the government for a particular financial year that begins on the 1st of April and ends on 31st March.